Paul Erickson, James Westwood, Robert Mulcahy, Brian Branch, John Dyer, Phillip Afif and Jake Gingell - Financial Advisors

|

|

|

|

|

(248) 672-7469 |

(248) 310-9638 |

(248) 709-6134 |

(248) 736-0272 |

(248) 990-0381 |

|

|

Phillip Afif |

|

(248) 854-4313 |

(734) 536-3291 |

Welcome to our Web site, where you'll find a wealth of information in the form of newsletter articles, calculators, and research reports.

We're here to help educate you about the basic concepts of financial management; to help you learn more about who we are; and to give you fast, easy access to market performance data. We hope you take advantage of this resource and visit us often. Be sure to add our site to your list of "favorites" in your internet browser. We frequently update our information, and we wouldn't want you to miss any developments in the area of personal finance.

*NEW* Click here to watch an exciting video of John Dyer and Paul Erickson explaining how dividends work from our Royal Oak offices.

Click here for RIA Channels interview with Paul Erickson from the TD Ameritrade LINC Conference. Paul discusses his investment approach for families and business clients.

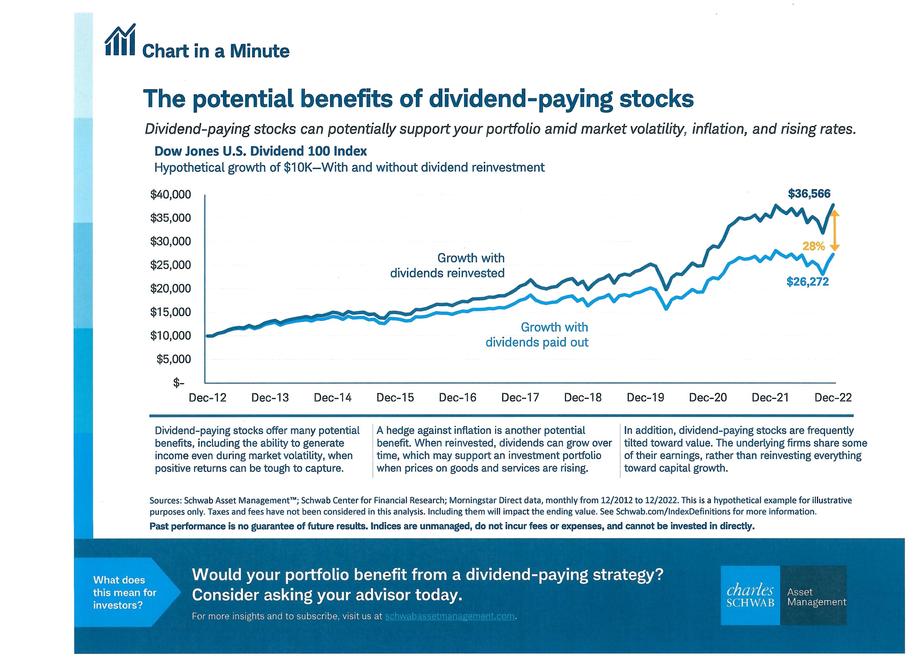

Dividend growth investing is a powerful investment strategy because it focuses on companies that have a track record of increasing their dividends over time. Dividends are a portion of a company's earnings that are paid out to shareholders, and dividend growth investing seeks to identify companies that have a history of increasing these payments year after year.

Here are some reasons why dividend growth investing can be so powerful:

- Consistent income: By investing in companies with a history of increasing dividends, you can create a steady stream of income that grows over time. This can be especially attractive for investors who are seeking a reliable source of income during retirement.

- Compounding returns: Dividend growth investing can also lead to compounding returns over time. As companies increase their dividends, you can reinvest those dividends to purchase additional shares of the stock. This can lead to a snowball effect where your investment grows faster and faster over time.

- Quality companies: Companies that are able to consistently increase their dividends over time are often high-quality companies with strong financials and stable earnings. By investing in these companies, you are investing in businesses that have a history of weathering economic storms and delivering long-term growth.

- Inflation protection: Dividend growth investing can also provide some protection against inflation. As the cost-of-living increases over time, companies that are able to increase their dividends can help offset some of the effects of inflation.

Overall, dividend growth investing can be a powerful strategy for investors who are looking to build a long-term, income-generating portfolio. However, it is important to talk to a fiduciary about your specific situation and goals for retirement

This is our Form CRS. It provides information about our relationship with our clients. Standardizing how information is provided will help clients better understand and compare offerings and services across our industry. (Form is in PDF format. You will need Adobe Acrobat to access it. Get it for free here.)